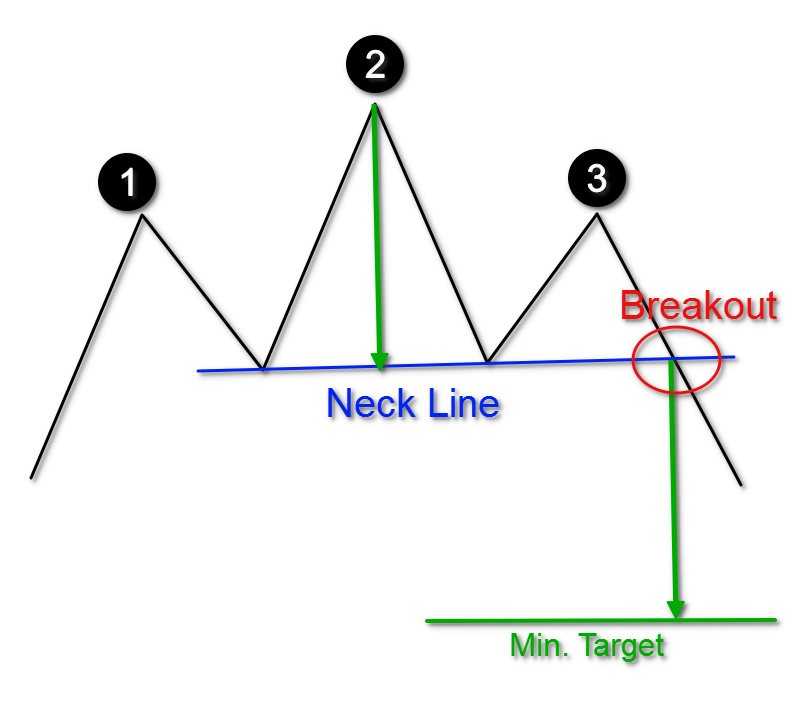

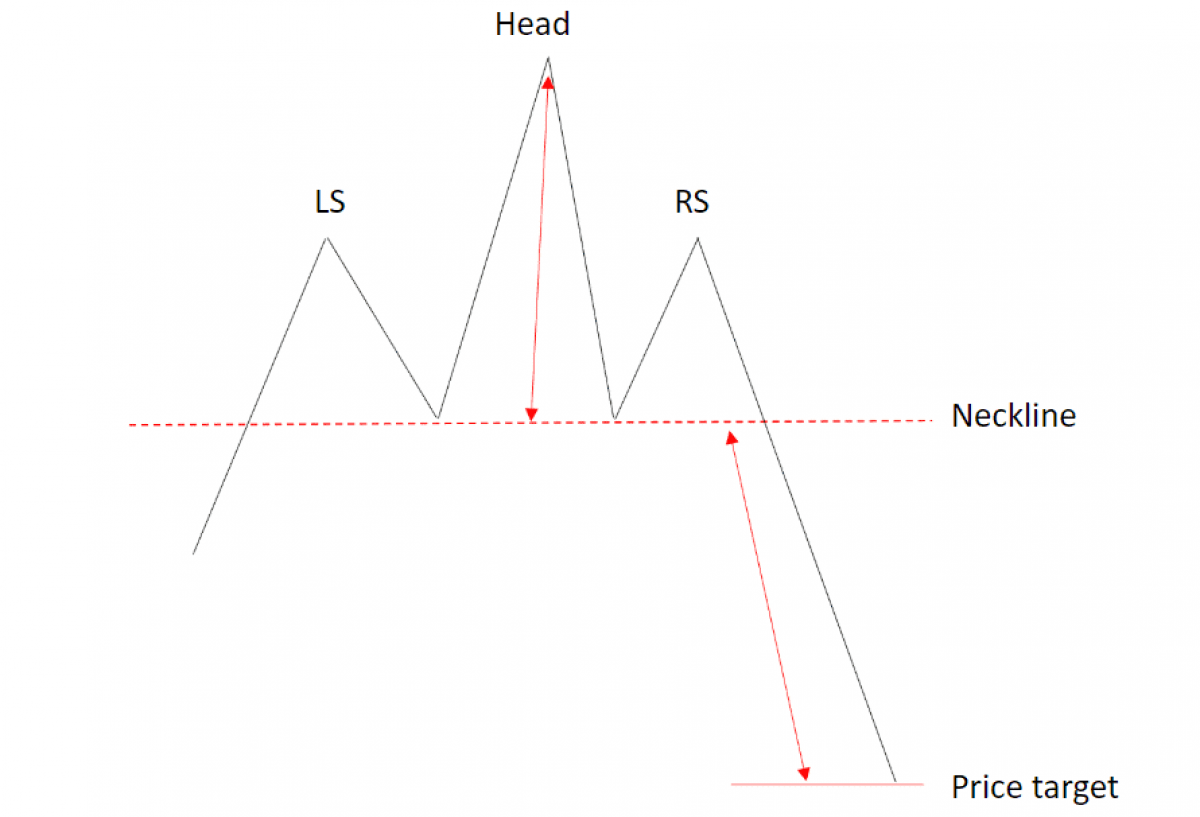

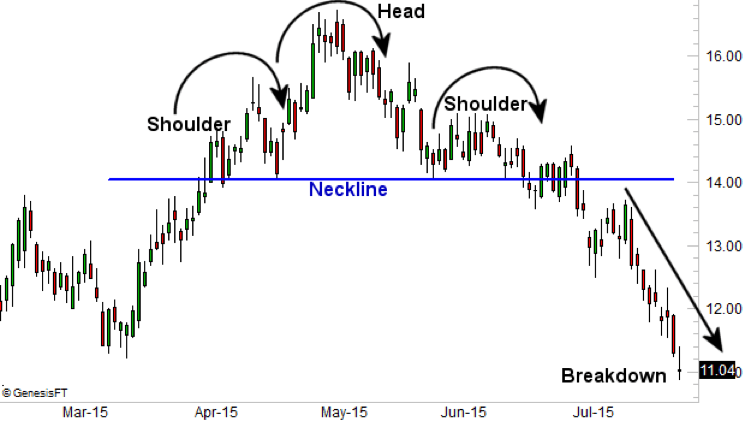

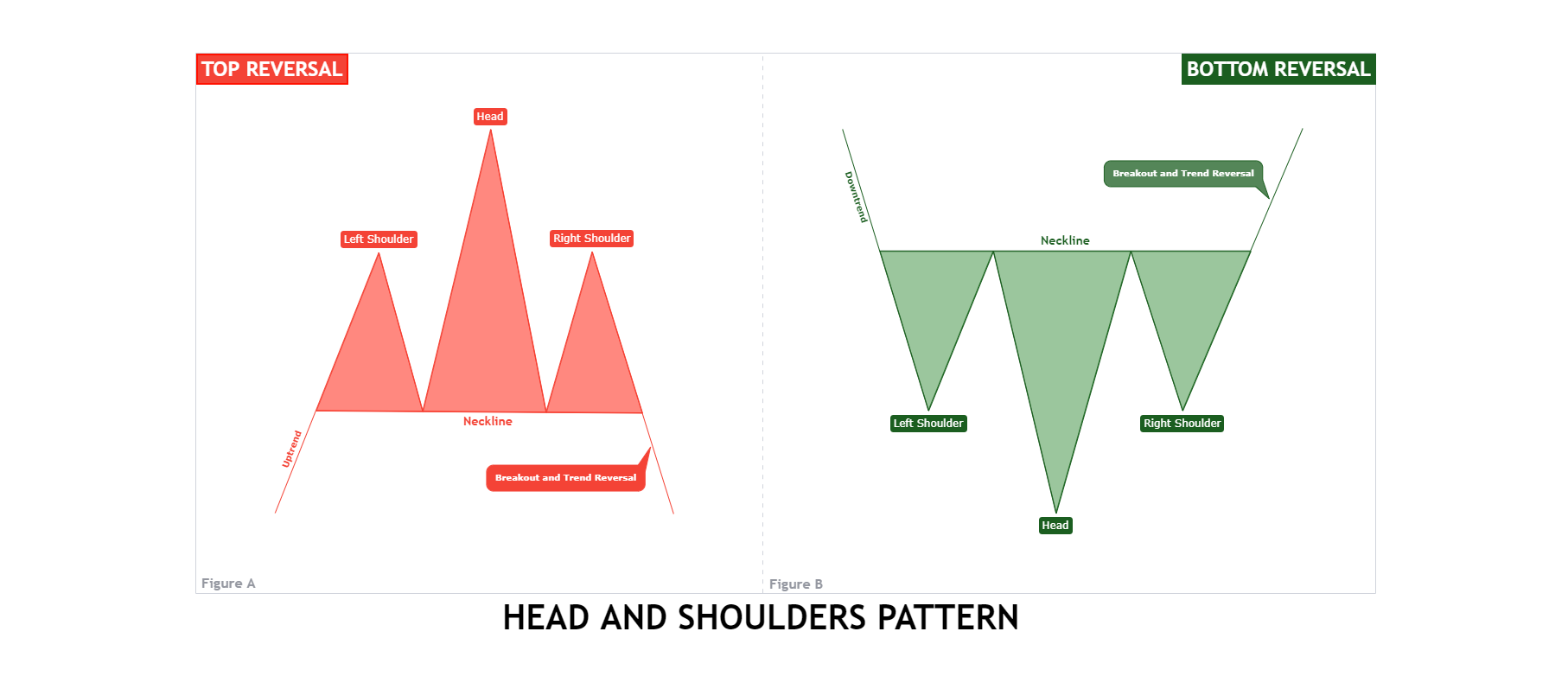

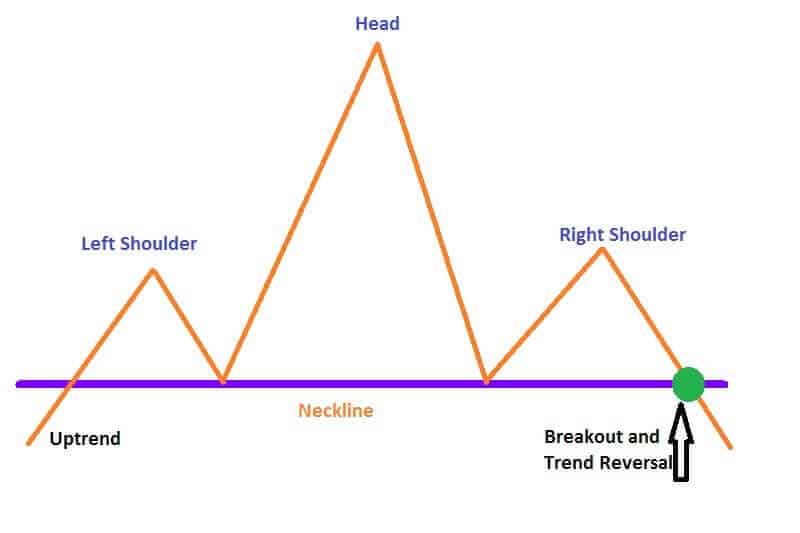

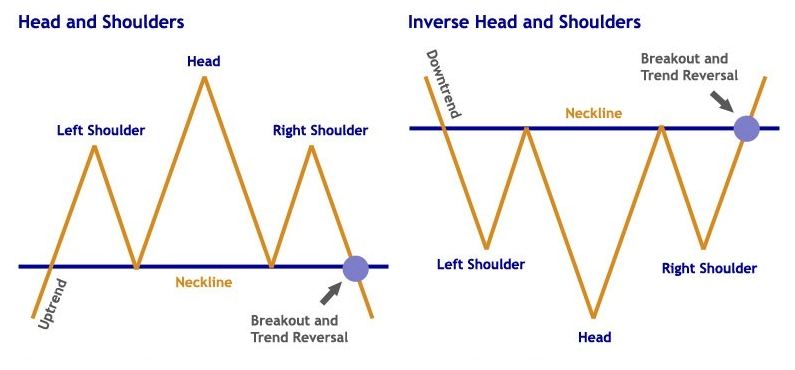

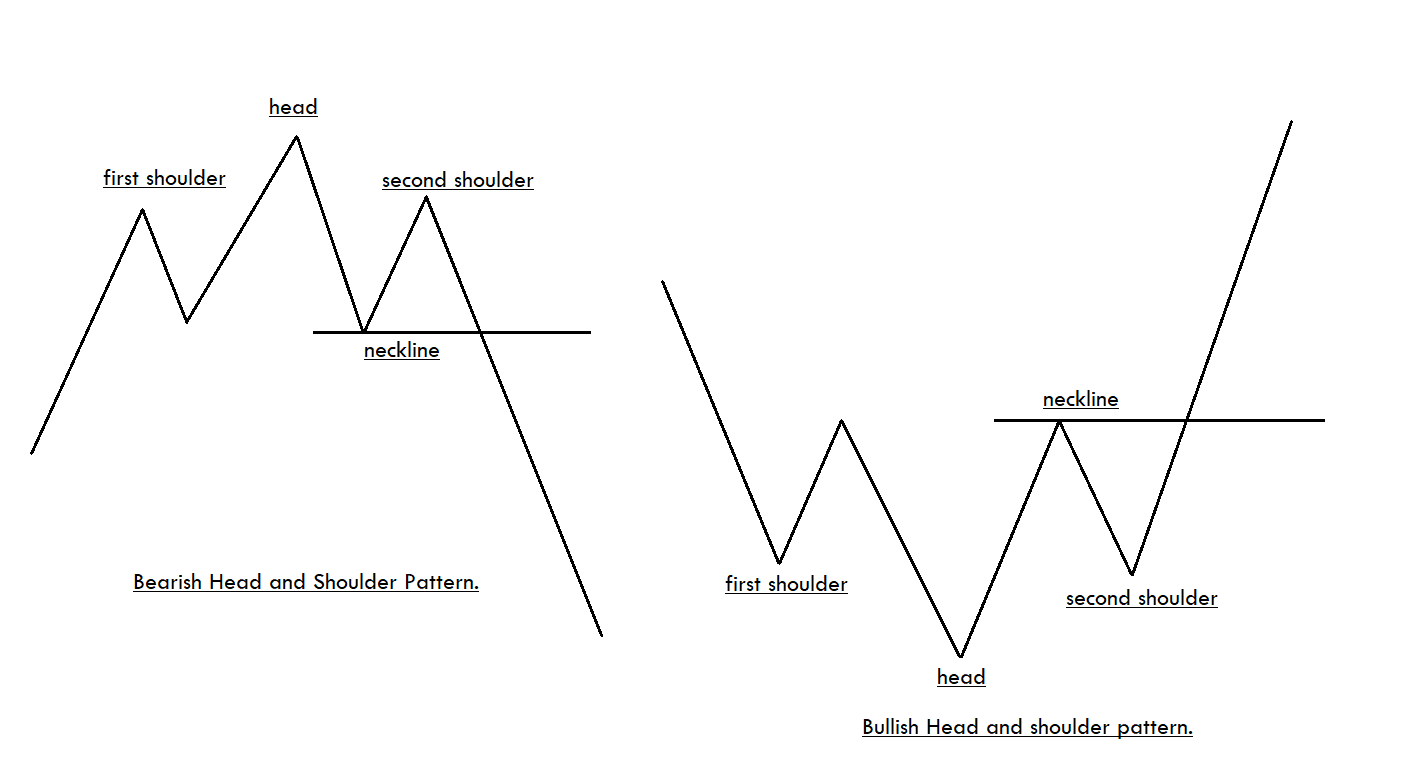

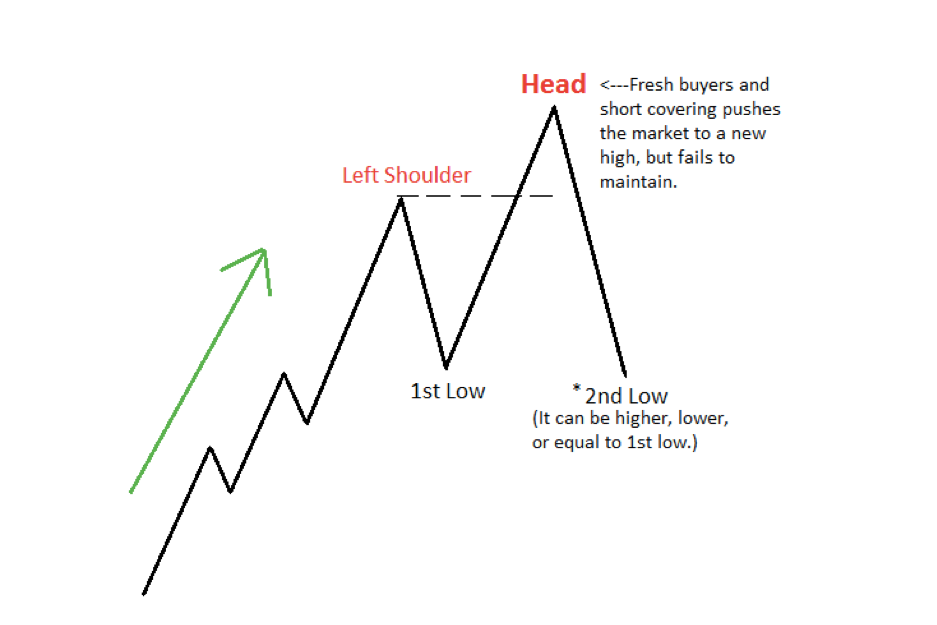

· // Bullish Bearish Head and Shoulder pattern SetOption("MaxOpenPositions",10); · Technicals of Head and Shoulders Patterns The head and shoulders pattern has 4 components The left shoulder, head, right shoulder and neckline After a long bullish trend, price rises to a peak then falls to form a trough This is the left shoulder Price rises again This time much higher than the first peak Then price falls again This forms the headThe first and third trough are considered shoulders, and the second peak forms the head The main take away here is that the reverse/inverse "Head and Shoulders" pattern is bullish reversal pattern Spotting this pattern early could lead to massive profits on the upside

Keys To Identifying And Trading The Head And Shoulders Pattern Forex Training Group

What is bullish vs bearish

What is bullish vs bearish- · The head and shoulders is a pattern commonly seen in trading charts The head and shoulders pattern is a predicting chart formation that usually indicates a reversal in trend where the market makes a shift from bullish to bearish, or viceversa11 hours ago · The inverse H&S pattern was far from being confirmed on Friday Technically, AUD/CAD could activate the Head & Shoulders pattern after jumping and stabilizing above the level Making a valid breakout above the neckline, through the immediate downtrend line and registering a new higher high could really validate a potential bullish reversal

Trading The Head And Shoulders Pattern Other Chart Patterns

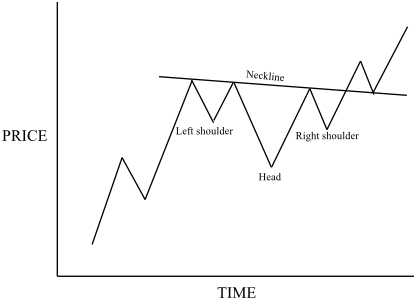

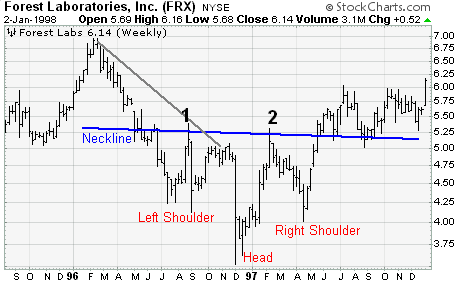

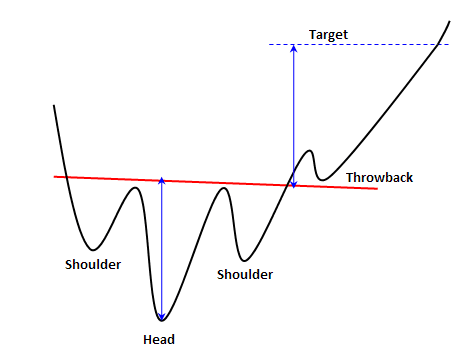

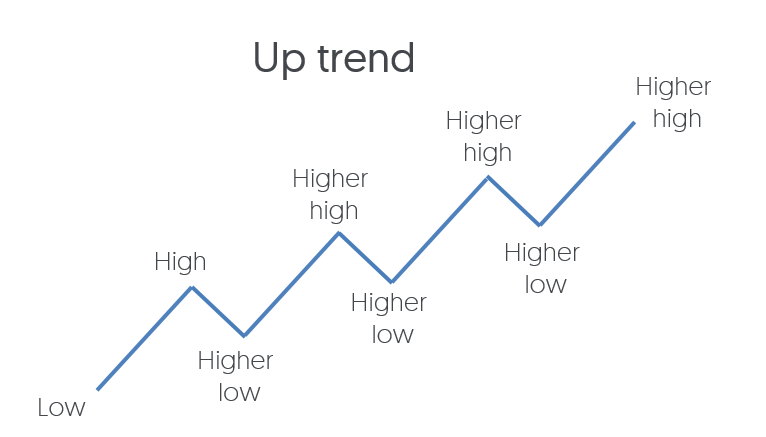

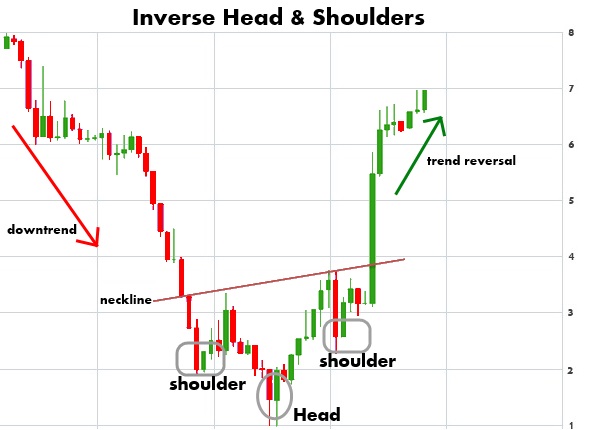

· The inverse head and shoulders pattern is a bullish reversal pattern that occurs when the stock stops making lower lows and begins to make higher lows The Relative Strength Index (RSI) shows that · Bullish Inverse Head And Shoulders Pattern As the debate carries on about whether we have hit a market bottom or not, some reliable chart patterns, can help identify if individual names could be safe to venture intoThe Head and Shoulders pattern is one of the most popular chart patternsHowever, most traders get it wrongHere's whyJust because you spot a Head and Shoul

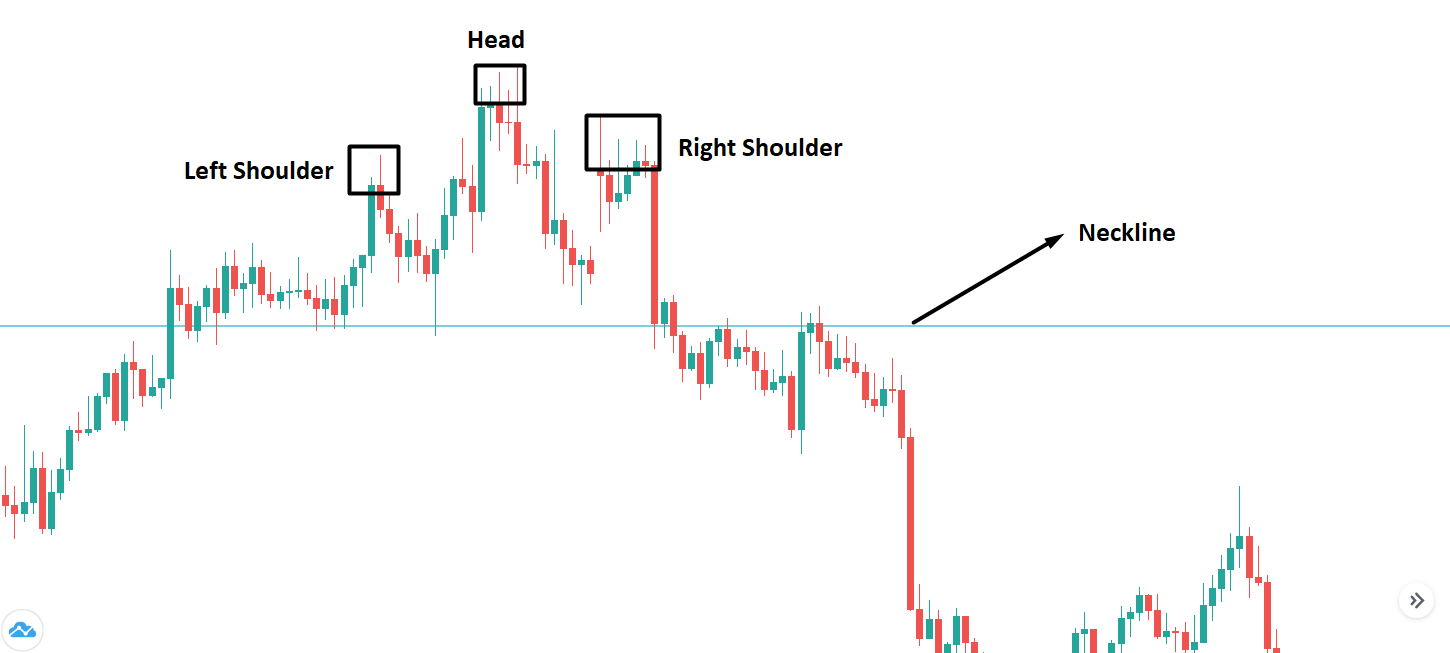

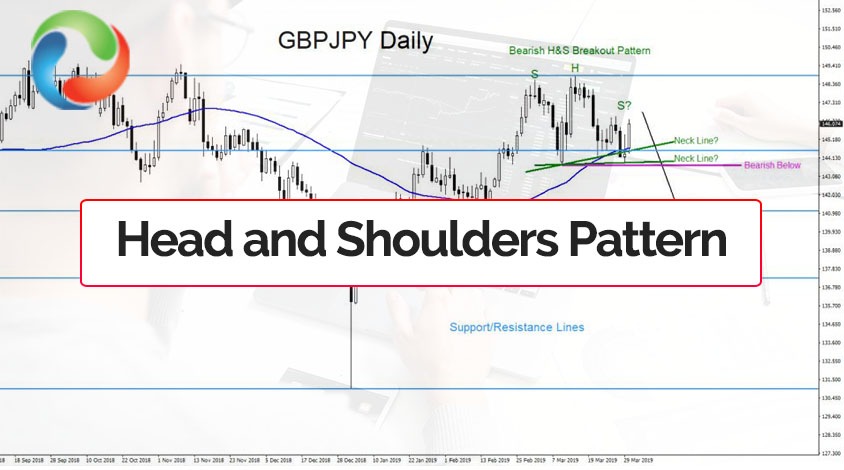

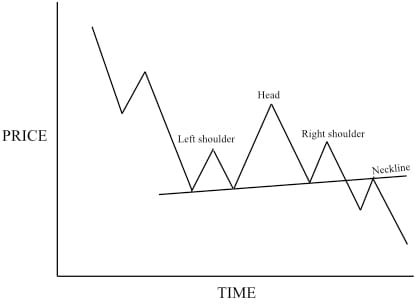

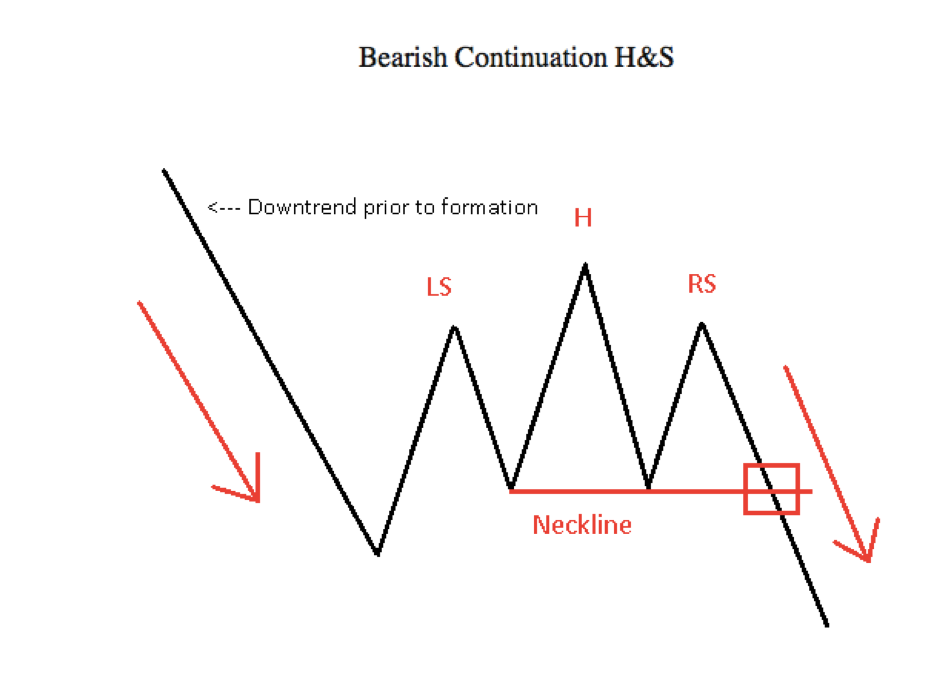

· Best head and shoulders pattern indicators for mt4 any broker you can use this pattern scanner Price breakout pattern scanner mt4 give you daily many signals for buy or sell trend market trad with long or short term trad session For long term trading with head and shoulders pattern indicator you must follow weekly or daily time frame for more accurate result · Head and shoulders is a reversal chart pattern that when formed, signals that the security is likely to move against the previous trend There are two versions of the head and shoulders chart patternThe head and shoulders pattern can signal a continuation rather than a reversal, although it appears in this role rather less Fortunately, you are not likely to get them confused, because the head and shoulders continuation appears in a downtrend, and the inverse head and shoulders appears in an uptrend Here is a bearish continuation pattern –

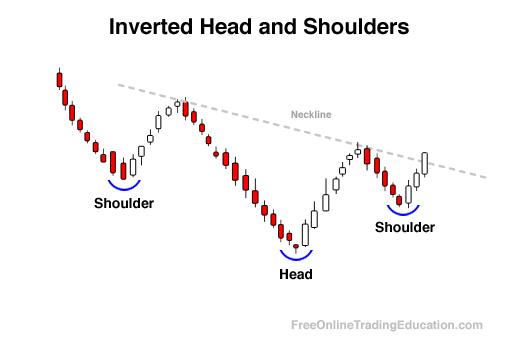

· Head and Shoulders is a bearish reversal pattern with a bullish equivalent called the Inverted Head and Shoulders pattern – as it occurs during downtrends and the head actually represents the lowest point of the formation · This prediction is also related to this pattern but this time it is included in a bearish and bullish trend Head and Shoulders Pattern (PDF) Rules 21 Trend reversals havesome reliable patterns that are located in the head and shoulders at top pattern signals This pattern degrees have some varying of currencies to make it more clear and · The overall trend remains bullishbiased as suggested by upwardsloped 50 and 100day SMA lines A typical inverse " Head and Shoulders " ("H&S") pattern was formed during midFebruary to early April when the Nasdaq 100 entered a technical correction This can be a strong bullish trendreversing indicator and is typically formed when a

What Are Inverse Head And Shoulders Patterns How To Trade

:max_bytes(150000):strip_icc()/dotdash_Final_How_to_Trade_the_Head_and_Shoulders_Pattern_Jul_2020-03-fe9a41ee5e9c497a8e135390b2caf104.jpg)

How To Trade The Head And Shoulders Pattern

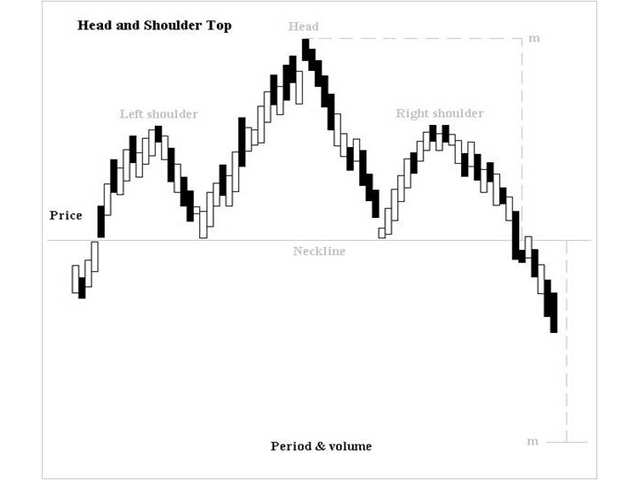

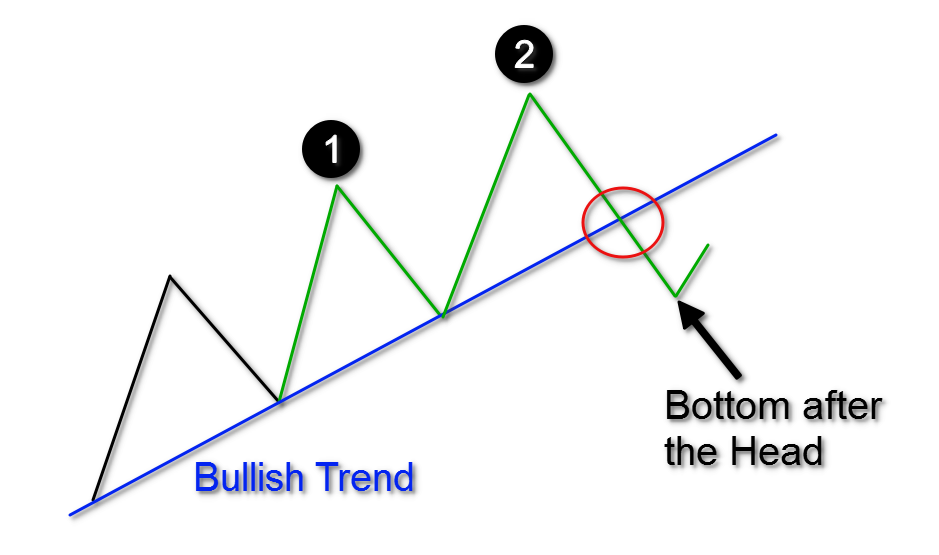

Bullish Continuation Chart Patterns Bullish continuation chart patterns signify a continuation in an uptrend So the first thing you want to look for is whether the market is in an uptrend Similarly for the inverted head and shoulders pattern, the 1st shoulder and head will form firstHead & Shoulders are reversal patterns (like double/triple tops/bottoms and wedges) that form at the top or bottom of a trend with the bottoms being Bullish and the tops being Bearish Each can can be split into distinct sections that help identify when the patterns are forming, helping ready the investor for the next move, be it higher or lower · The bullish inverted head must be made on lighter volume The rally from the head must have a greater volume than the rally from the left shoulder Ultimately, the inverted right shoulder has the lightest volume of all When the stock rallies and breaks through the neckline, you'll see a massive increase in volume

Head And Shoulders Pattern Trading Guide In Depth Trading Setups Review

Inverse Head And Shoulders Chart Pattern Forex Trading Strategy

· In technical analysis, a head and shoulders pattern describes a specific chart formation that predicts a bullishtobearish trend reversal, while an inverse head and shoulders · May 29, 21 admin Inverted head and shoulders chart pattern analysis in Hindi Reverse head and shoulder is a bullish continuation pattern which leads price target at top of previous high inverse Head and shoulders pattern rules is very simple, it is a bullish pattern Open Professional Fyers Trading Account and avail discount on our course · In AUD/JPY, the pair has built into a longerterm inverse head and shoulders pattern For the past month, AUD/ JPY bulls were stymied by

What Is Head And Shoulders Definition Of Head And Shoulders Head And Shoulders Meaning The Economic Times

What Are Head And Shoulders Patterns And How To Trade

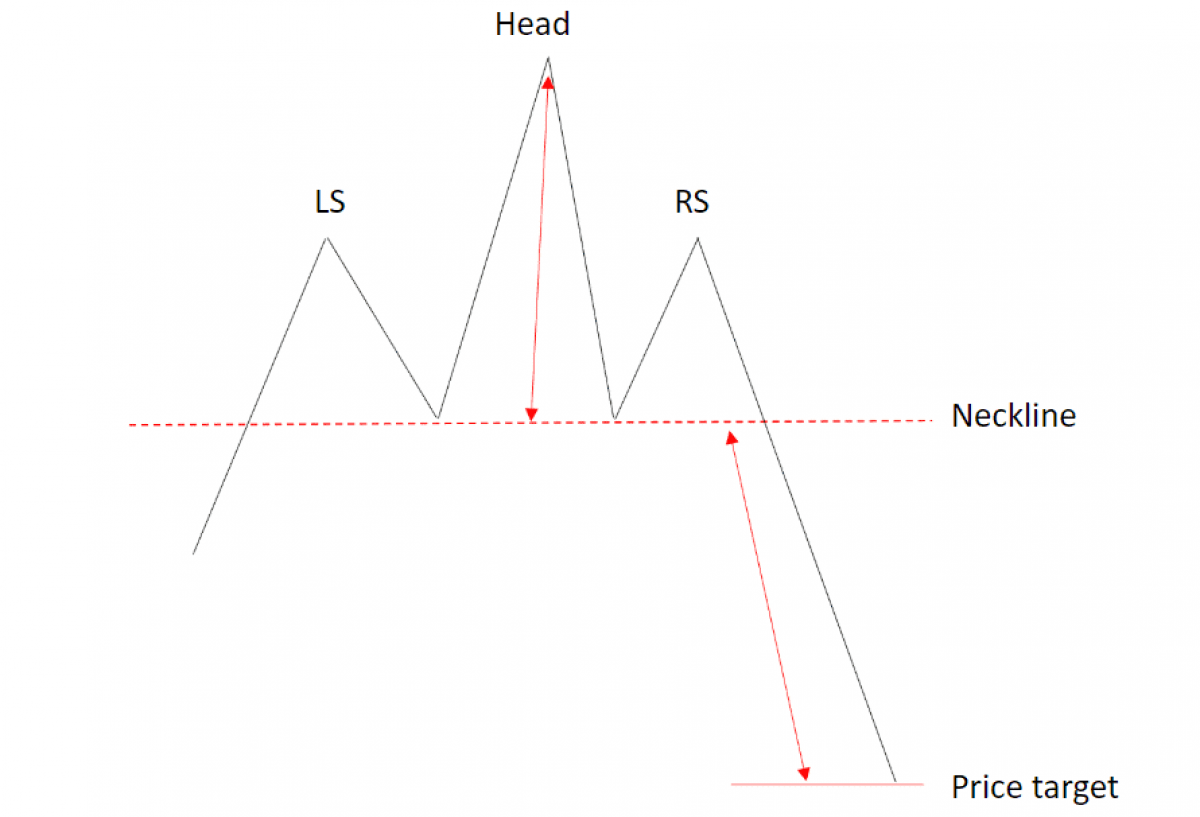

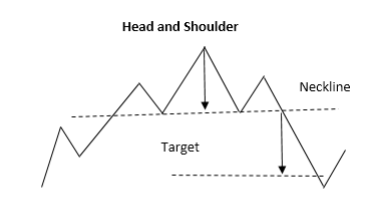

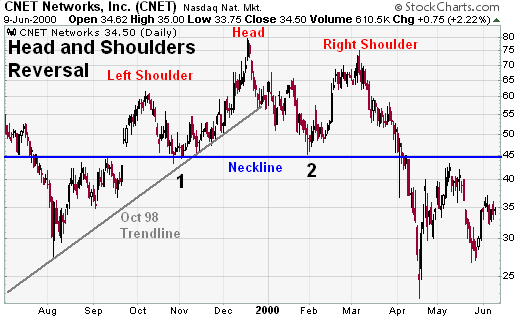

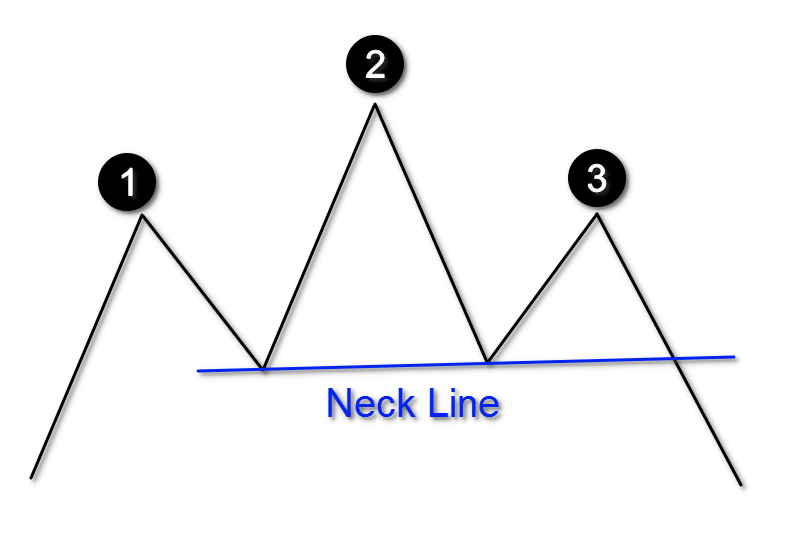

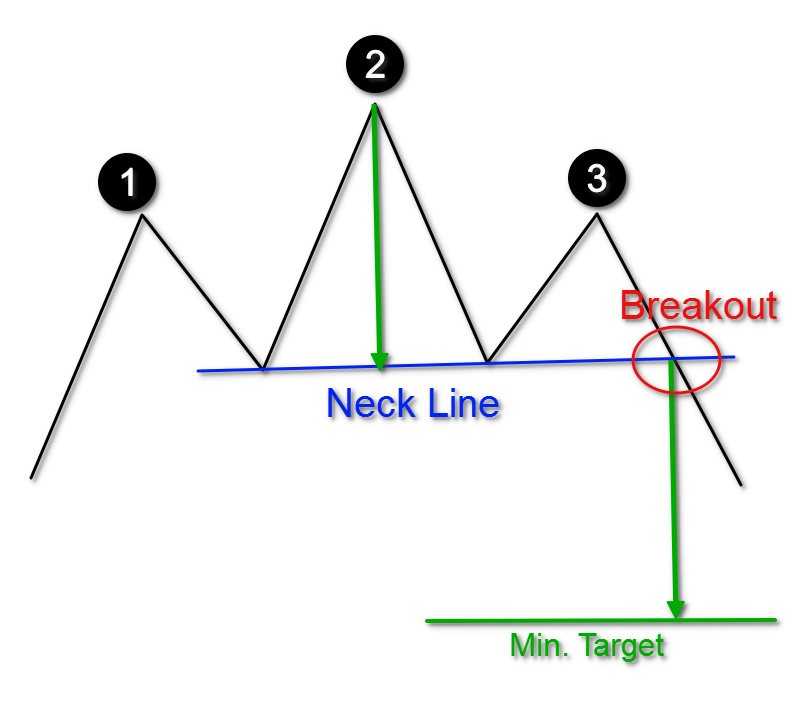

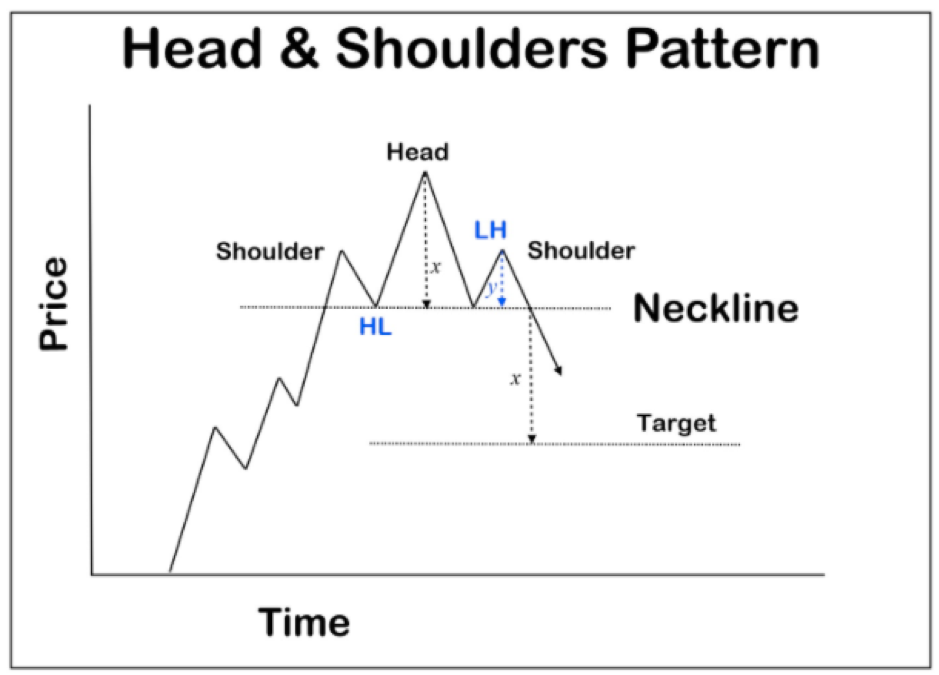

The head and shoulders chart shows a bullish to bearish trend reversal It indicates that an upward trend is coming to a close The pattern can be used by novice and experienced traders to predict both forex and stock markets The Head and Shoulders (H&S) top pattern is composed of three peaks The two outside peaks are about the same heightA head and shoulders pattern is a chart formation that appears as a baseline with three peaks, the outside two are close in height and the middle is highest In technical analysis, a head and · The Head and Shoulders Pattern is a trend reversal pattern consisting of three peaks The two outside peaks are in the same height, while the middle one is the highest The pattern identifies a bullish to a bearish trend reversal and emerges in an uptrend

Head And Shoulders Pattern Trading Target Indicator Neckline Example

Trading The Head And Shoulders Pattern Other Chart Patterns

· DXY is trading right at the neckline from a head and shoulders bottom pattern The objective from the pattern is 9280 (magenta line) but the former low at 9175 is a possible pausing level Ultimately, I'm looking towards the underside of former channel support This is near 95 and in line with the March low, former 4th wave high, and 3% retrace of the decline from the · Head and shoulders tops and bottoms are reversal chart patterns, which can develop at the end of bullish or bearish trends Traders like to trade head and shoulders formations as the price targets are very predictable and · Standard head and shoulder patterns are an indicator of a sizable downward price reversal from a prior upward trend, so head and shoulder patterns are bearish On the other hand, reverse, or inverse head and shoulder patterns indicate a bullish chart reversal from a downward trend to an upwards trend

Chart Examples Of Inverted Head And Shoulders Patterns

Trading The Inverse Head And Shoulders Pattern Warrior Trading

· The bullish variant of the Head and Shoulders pattern is the Inverse Head and Shoulders pattern An Inverse Head and Shoulders pattern is likely to form after a declining trend and is simply an · The head and shoulders patterns are statistically the most accurate of the price action patterns, reaching their projected target almost 85% of the time The regular head and shoulders pattern is defined by two swing highs (the shoulders) with a higher high (the headThe Head and Shoulders pattern has its bullish equivalent This is the inverted Head and Shoulders pattern Contrary to the H&S pattern, the inverse H&S pattern appears during a bearish trend and it implies that the existing bearish tendency is likely to be reversed This pattern looks the same as the standard Head and Shoulders, but inverted

Trading The Most Popular Head And Shoulders Pattern Forex Strategy Forex Academy

Chart Patterns Learn Basics Types Of Chart Patterns

· The red metal's bounce off $ portrays a bullish pattern on the fourhour play, namely the inverse headandshoulders However, a clear break above becomes necessary toThis pattern predicts a bullishtobearish trend reversal The head and shoulders pattern is believed to be one of the most reliable trend reversal patterns It is one of several top patterns that signal, with varying degrees of accuracy, that an upward trend is nearing its end" ( Credit Investopedia See the full article here) · In technical analysis, a head and shoulders (or H&S) pattern predicts a bullishtobearish trend reversal and is regarded as one of the most reliable trend reversal patterns which, if spotted correctly, reveal that an uptrend is nearing its end As the cryptocurrency market is a constant battle between bulls and bears, the head and shoulders

Head And Shoulders Pattern Trader S Ultimate Guide Patternswizard

Keys To Identifying And Trading The Head And Shoulders Pattern Forex Training Group

When the head and shoulders pattern occurs within an uptrend, the pattern starts with the price rising and then pulling back (lower), forming the left shoulder The price rallies again, creating a higher peak, which is known as the peak of the head The price moves lower once again, and then rallies into a lower peak, forming the right shoulderThe Head and Shoulders pattern can also form in the opposite direction Also known as the Head and Shoulders Bottom or the Inverted Head and Shoulders, the bullish version of the pattern establishes at the bottom of the downtrend and implies that the existing bearish tendency is likely to be reversed, and the price will head higher · The Head and Shoulders pattern occurs when the price of security starts rising, marking the bullish trend, and reaches a new high level However, the rise in prices is shortlived and the prices start to drop This drop in prices is not for long when the bullish trend makes a comeback and the prices escalate reaching new higher levels

Inverse Head And Shoulders Pattern Update Daily Price Action

Head And Shoulders Continuation Pattern

INVERTED HEAD AND SHOULDERS AS A REVERSAL PATTERN IN A MINOR DOWNTREND (BULLISH) This inverted head and shoulders pattern reversed a minor downturn And while the right shoulder's decline exceeded the left shoulder's, the pattern effectively ended the downtrend Volume declined on the bottoms and picked up on the breaking of the neckline · While we've obviously been in a bear trend for the past weeks, Cardano might be indicating that a reversal is imminent Here are the three patterns/ indicators I am closely watching 1 Falling wedge reversal pattern, theoretical target at the beginning of the pattern 2 Inverted head and shoulders work the same way as a regular head and shoulders 3 9/30 crossHead and Shoulders chart pattern for Forex, stocks and Eminis http//wwwtopdogtradingnet/youtubeorganicforexThe Head and Shoulders pattern is

How To Trade The Head And Shoulders Pattern

How To Trade The Head And Shoulders Pattern Update

The trading strategy The best forex system (Check Link In The Description) Tuyệt Kỹ MÔ HÌNH NẾN NHẬT Thân Nến Bóng Nến Bài 1 TraderViet Top Forex Bro · A potential inverted head and shoulders (blue boxes) could emerge as a reversal chart pattern Price will need to break to confirm the reversal In that case, price action could complete wave B · A typical inverse "Head and Shoulders" ("H&S") pattern was formed during midFebruary to early April when the Nasdaq 100 entered a technical correction This can be a strong bullish trendreversing

Head And Shoulders Pattern How To Identify Use It

Continuation And Reversal Head And Shoulder Patterns Forex Market

The Head and Shoulders pattern is an accurate reversal pattern that can be used to enter a bearish position after a bullish trend It consists of 3 tops with a higher high in the middle, called the head The line connecting the 2 valleys is the neckline The height of the last top can be higher than the first, but not higher than the headPlease visit head and shoulders pattern Reply Delete Replies Reply Unknown 15 July at 0211 Hi i noticed there is a green dot, red that, green arrow and red arrow There is also a white dot · The Inverse Head and Shoulders pattern is a bullish chart pattern And when you trade the Inverse Head and Shoulders Pattern in an uptrend, BOOM, you've just increased your odds of winning Here's an example When the pattern leans against the higher timeframe structure On its own, the Inverse Head and Shoulders pattern isn't significant

Eur Usd Busted Bearish Head And Shoulders Becomes Bullish Head And Shoulders

Head And Shoulders Technical Analysis Corporate Finance Institute

A head and shoulders could take bulls by surprise, before moving higher again Source BTCUSD on TradingViewcom The Ongoing Showdown Between Bullish BTC Fundamentals And Bearish Technicals The battle between buyers and sellers of Bitcoin is currently at an impasse, and when either side eventually waves the white flag, there could be a long streak of green or red to follow

Inverse Head And Shoulders Pattern Update Daily Price Action

Head And Shoulders Pattern Trading Guide With Rules Examples

How To Trade The Inverse Head And Shoulders Pattern

Head Shoulders Patterns Bullish And Bearish Accendo Markets

Inverse Or Inverted Head And Shoulders Pattern Chart Patterns

Head And Shoulders Top Chartschool

Inverse Head And Shoulders Pattern Update Daily Price Action

The Head And Shoulders Pattern A Trader S Guide

Head And Shoulders Chart Pattern Wikipedia

117 How To Trade The Head And Shoulders Forex Chart Pattern Forex Academy

How To Trade The Head And Shoulders Pattern Update

Head And Shoulder Double Top And Double Bottom Chart Patterns Strategy Fx Trading Revolution Your Free Independent Forex Source

:max_bytes(150000):strip_icc()/dotdash_Final_Head_And_Shoulders_Pattern_Sep_2020-01-4c225a762427464699e42461088c1e86.jpg)

Head And Shoulders Pattern Definition

Head And Shoulders Trading Patterns Thinkmarkets

Learn Forex A Simple Price Pattern That Can Precede Big Moves

How To Trade The Head And Shoulders Chart Pattern Currency Com

Head And Shoulders Pattern Trading Strategy Guide Updated 21

Inverse Head Shoulders Futures

Head Shoulder Failure Tech Charts

Head And Shoulders Bottom Chartschool

Head And Shoulders

Learn How To Use The Head And Shoulder Pattern In Tradingview For Cme Mini Es1 By Forextidings Tradingview

Keys To Identifying And Trading The Head And Shoulders Pattern Forex Training Group

Inverted Head And Shoulders Trading Pattern

Head And Shoulder Double Top And Double Bottom Chart Patterns Strategy Fx Trading Revolution Your Free Independent Forex Source

Head And Shoulders Pattern Interpretation With Examples

Bullish Inverse Head And Shoulders Pattern Chart Smarter

Head And Shoulders Pattern How To Use Traders Paradise

Reverse Head And Shoulders Personal Finance Lab

The Head And Shoulders Pattern A Trader S Guide

Tricks Of The Trade The Head And Shoulders Pattern Part 1

/dotdash_Final_Inverse_Head_And_Shoulders_Definition_Feb_2020-01-97f223a0a4224c2f8d303e84f4725a39.jpg)

Inverse Head And Shoulders Definition

Keys To Identifying And Trading The Head And Shoulders Pattern Forex Training Group

Chart Patterns The Head And Shoulders Pattern Forex Academy

Head And Shoulders Pattern The Head And Shoulders

What Is An Inverse Head And Shoulders Pattern H Si

Part V Inverse Head And Shoulders Price Targets Stockviz

Head And Shoulders Pattern Interpretation With Examples

Head And Shoulders Pattern Trading Guide In Depth Trading Setups Review

117 How To Trade The Head And Shoulders Forex Chart Pattern Forex Academy

Head And Shoulders Pattern Trading Strategy Guide Updated 21

:max_bytes(150000):strip_icc()/dotdash_Final_How_to_Trade_the_Head_and_Shoulders_Pattern_Jul_2020-01-d955fe7807714feea05f04d7f322dfaf.jpg)

How To Trade The Head And Shoulders Pattern

Head And Shoulders Pattern Trading Guide With Rules Examples

Head And Shoulders Pattern Trading Strategy Guide Updated 21

Head And Shoulders Pattern Trading Guide In Depth Trading Setups Review

Head Shoulders Patterns Bullish And Bearish Accendo Markets

Inverse Head And Shoulders In Forex Identify Trade Free Forex Coach

The Head And Shoulders Pattern A Trader S Guide

The Head And Shoulders Pattern A Trader S Guide

Head And Shoulders Pattern Explained In Details

Head And Shoulders Pattern All You Need To Know Living From Trading

Head And Shoulders Continuation Pattern

Head And Shoulders Pattern Trading Strategy Guide Updated 21

A Short Explanation The Head And Shoulders Chart Pattern By Cryptotutor Medium

:max_bytes(150000):strip_icc()/dotdash_Final_How_to_Trade_the_Head_and_Shoulders_Pattern_Jul_2020-02-694fa56fd5aa47d4877ff9a29d669563.jpg)

How To Trade The Head And Shoulders Pattern

How To Trade The Head And Shoulders Pattern In Forex Babypips Com

Pattern Search Engine Head And Shoulders Top Bearish Tickeron

The Inverse Head Shoulders Pattern Multiplier Wealth

Discussion Of Article Reversal Patterns Testing The Head And Shoulders Pattern Head And Shoulders Pattern Articles Library Comments Mql5 Programming Forum

Inverse Head And Shoulders Pattern Trading Strategy Guide

Keys To Identifying And Trading The Head And Shoulders Pattern Forex Training Group

Example How To Properly Sell The Head Shoulder Pattern For Fx Eurusd By Tayfx Tradingview

How To Trade The Head And Shoulders Pattern Update

Head And Shoulders Pattern Trading Strategy Guide Updated 21

How To Trade Head And Shoulders Tops And Bottoms

A Short Explanation The Head And Shoulders Chart Pattern By Cryptotutor Medium

Head And Shoulders Ace Gazette

Inverse Head And Shoulders Chart Pattern Forex Trading Strategy

How To Trade The Head And Shoulders Pattern In Forex Keysoft

Video Inverse Head And Shoulders Chart Pattern

Head And Shoulders Pattern How To Identify Use It

Video Inverse Head And Shoulders Chart Pattern

Reverse Head And Shoulders Pattern The Hot Penny Stocks

:max_bytes(150000):strip_icc()/es-one-minute-chart-inverse-head-and-shoulders-56a22dda3df78cf77272e810.jpg)

How To Trade The Inverse Head And Shoulders Pattern

How To Trade The Head And Shoulders Pattern In Forex Babypips Com

Head Shoulder Chart Patterns Learn Why Traders Use Them So Much Commodity Com

Head Shoulder Chart Patterns Learn Why Traders Use Them So Much Commodity Com

A Short Explanation The Head And Shoulders Chart Pattern By Cryptotutor Medium

0 件のコメント:

コメントを投稿